Funds Raising:

Debt and Capital

Funds Raising:

Debt and Capital

The common denominator of the new available financial instruments can be called “flexibility “.

They can be used in financial structures, compatible with the traditional bank financing, to address larger projects, either with higher complexity, or with repayment flows better suited to the characteristics of each investment need, and all of these with a much greater probability of success in its achievement.

The study and approval of these operations are based, even more if possible, on the repayment capacity supported by predictive financial models, with their corresponding risk analysis and sensitivity to different scenarios, seeking a balance in the structure of funding sources, so that each financial operator can assume just its main expertise in risk and return, preventing from having to rule out viable projects not just suitable for its mere bank financing.

We can help you with the analysis of project´s risks, with its modeling, and in the design of its financial structure, with ordinary bank debt, alternative debt, senior or junior, or pure equity instruments, making that the final mix of cost and structure were solid and attractive. We can also help you in finding your capital providers, and adequately explain them the benefits of your project, and getting you a new base of specialized financial partners, including new bank relationships, to help you to develop your ideas.

We can also assist you in quoted markets, where we have advised on IPOs, relationships with investors, analysts and market, and other operations in quoted markets, where we maintain an intense relationship with securities companies and other specialized operators.

We have been building relationships worldwide with the best financial operators for more than twenty years, calibrating and improving our financial models, and adapting them to their requirements and specifications, to facilitate the understanding and management of your operations. We will put all this experience at your disposal.

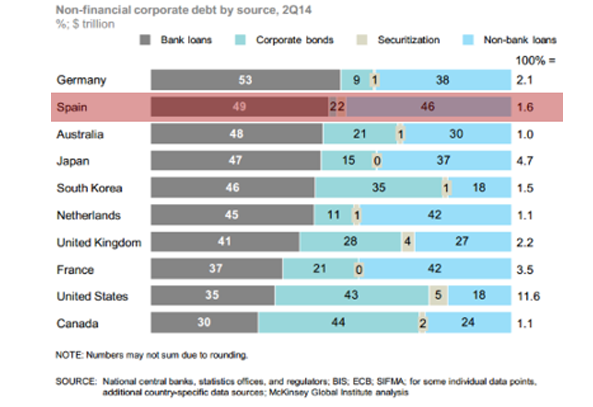

In Spain there is already an important Non-Bank alternative financial market, both in instruments of Debt and Equity, and Hybrids. Spain is the fourth country in Europe for alternative financing operations, ahead of Italy.

Allow a Great flexibility in amounts, structure, terms and conditions, in addition to substantially increasing the Chances of success in its obtaining.

Can act as a complement or substitute for bank financing, allowing to tackle projects that are difficult to finance with traditional structures, or in more complicated times of rates rising or market restrictions, growth, internationalization, etc..