Acquisitions

Let us to help you find the correct candidate, either in the process of buying, selling or seeking alliances, and let us also generate new opportunities for you.

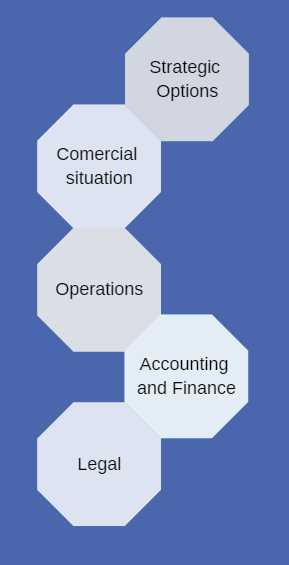

Our methodologies for Strategic Analysis, and Financial Modeling, can be of great help in the phases of Negotiation, Due Diligence, and Financing, or Integration of the Transaction. The issuance of our valuation opinion, subject to international standards, will help you dispose of a complementary and independent vision.

The deep detail of our financial models will identify the areas of more priority and sensitive in the process of Due Diligencie and in the subsequent Integration.

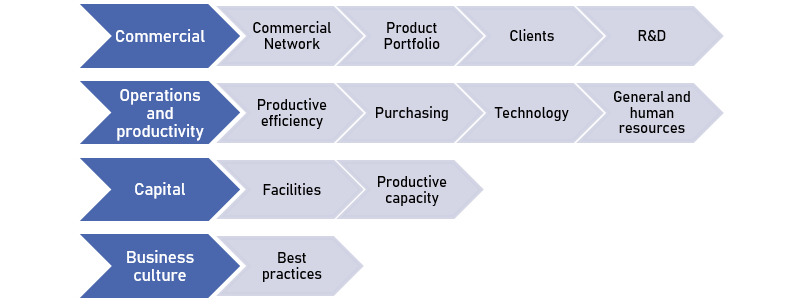

Our functional specialists will work with your Team to design and achieve the best and fastest Integration, and to take advantage of all the benefits and possibilities of the operation.